In the trading world, there are various types of traders. But for the active cases, there are two...

In the trading world, there are various types of traders. But for the active cases, there are two main parties:

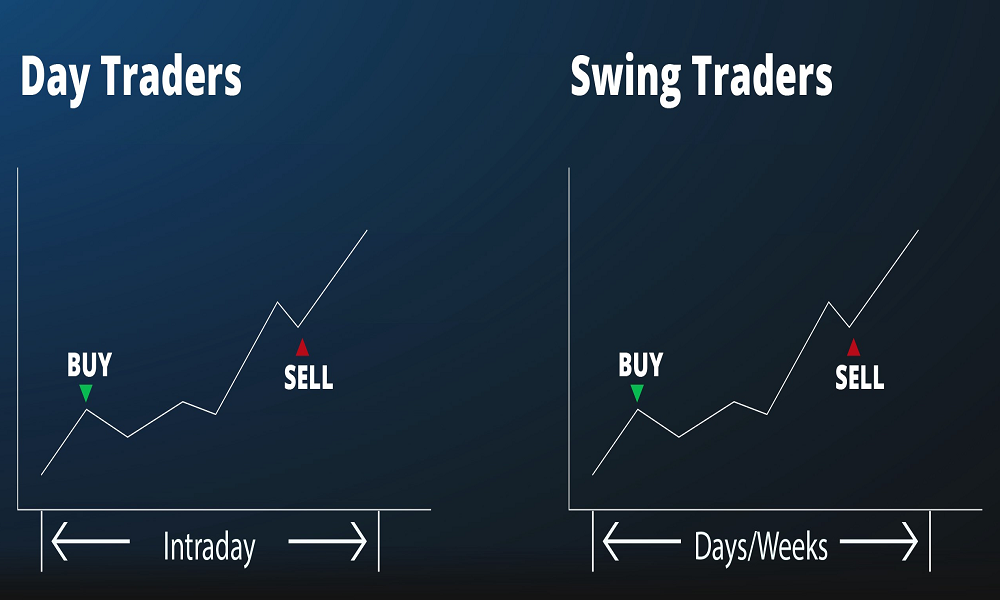

1. the day traders and 2. the swing traders.

Both traders are highly seeking to profit in short-term price movements, but they are following individual strategies.

So, in this article, we will reveal the differences between Day Trading vs Swing Trading. So, don't waste time anymore, let's get started-

Day trading means making multiple trades in a single day. Technical analysis is the main key to day traders. Day traders are mostly involved with trading as a job. The U.S. Securities and Exchange Commission (SEC) claims that "day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status." They make a living by trading stocks, commodities, currencies and make small profits on lots of trades and reduce losses on unprofitable losses.

Swing trading means trading which identity by swings in stocks, commodities, and currencies that take place over a period of time. A swing trader needs a week or a couple of days to make a trade. But swing traders can not make carriers like day traders. Though a trade can select a profession between a day trader or a swing trader.

Being a swing trader is not so hard. Anyone can be a swing trader with some investment capital and knowledge. Because of the long-term conditions, they do not need to sit all day long before the screens. They can continue a full-time job besides trading.

Both trading types have advantages and disadvantages. Swing trading and day trading has a good strategy and both have their own preferences. Where a trader is skillful, dedicated, patient and his hard work rely on which strategy he will work on. But day trading is suitable for those who want to trade during the full day and make sure that it is his only profession.

|

Day Trading |

Swing Trading |

|

Multiple Trading in a Day |

Several trades per week |

|

Full-Time Trader |

Part-Time Trader |

|

Trades hold hours to days |

Trades hold days to weeks |

|

Use short-term buy-sell strategy |

Analyze momentum and trend strategy |

|

Using multiple screens with advanced trading technology |

A Standard account may require |

|

Multiple, smaller gains or losses |

Fewer, but more profits or losses |

Day trading and swing trading are pretty popular among traders. Both trading types have advantages and disadvantages. But in this article, we see in spite of disadvantages, both trading strategies are the main reason for millions of traders' subsistence. It affects a huge impact on trading careers around the world. But with proper knowledge and accruing the proper facilities are the only reason for profitable trading. That's why you must keep learning.

We wish you a profitable trading career!