BTC price fell to fresh lows of $36,000, prompting analysts to call for a “Hail Mary close...

BTC price fell to fresh lows of $36,000, prompting analysts to call for a “Hail Mary close above $39,600” to prevent a bearish shift in Bitcoin market structure. Bitcoin (BTC) price continues to sell off and the ripple effect is an even sharper correction in altcoins and DeFi tokens.

At the time of writing, BTC's price has fallen to its lowest level in 6 months and most analysts are not optimistic about an immediate trend reversal.

Data from Cointelegraph Markets Pro and TradingView shows that a selloff that began late on the day of Jan. 20 continued through midday Friday when BTC hit a low of $36,600.

Here's a check of what analysts have to say about the current recession and what could be in store for the coming weeks.

Traders Expect Consolidation Between $38,000 and $43,000

BTC's sudden price drop has prompted many cryptocurrency traders to forecast several dire outcomes in the sense of an extended bear market.

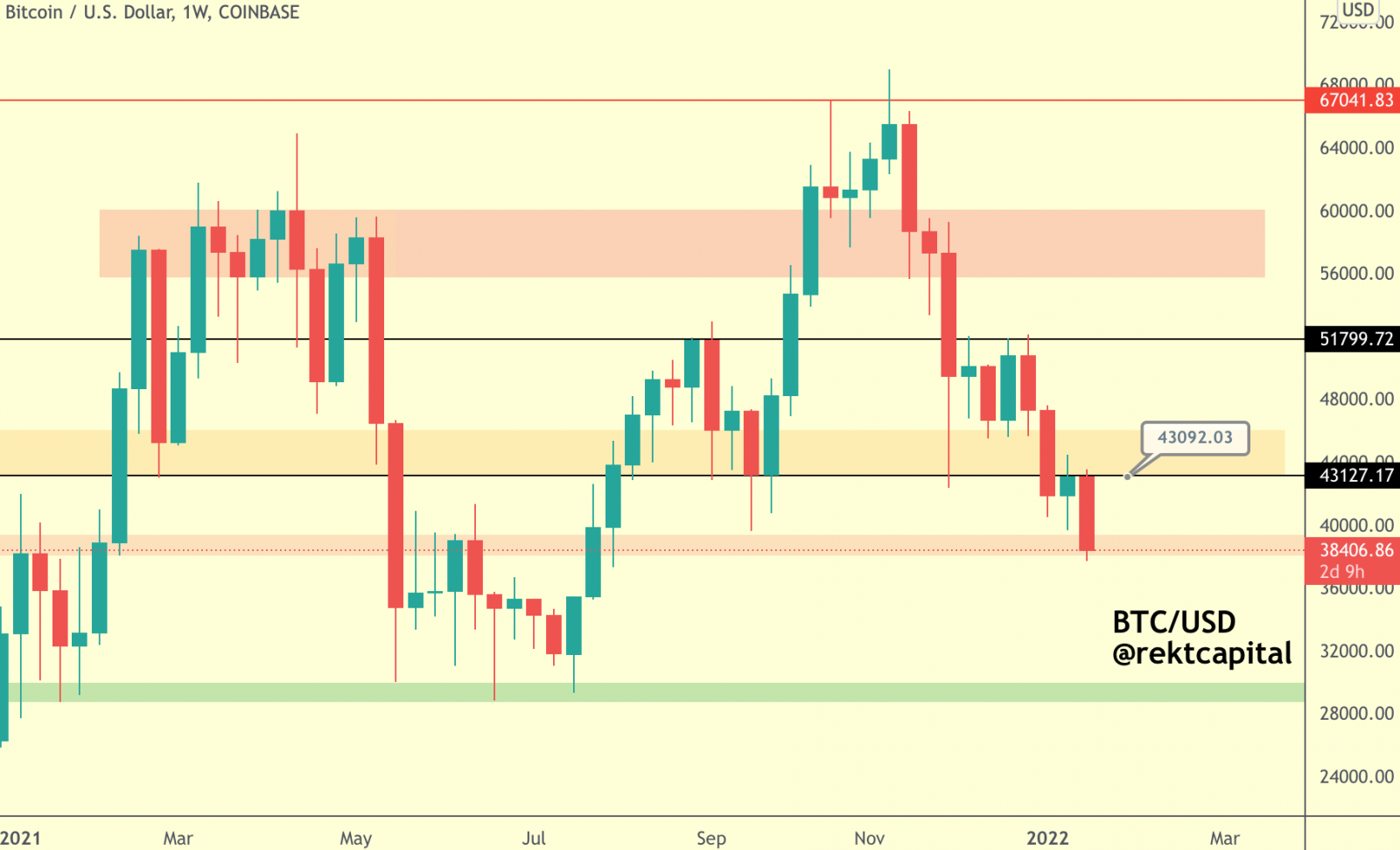

Others, like independent market analyst Rekt Capital, are not so quick to skip the gun and declare all is lost.

As shown in the chart below published by Rekt Capital, “BTC's recent rejection means that BTC is now in the bottom of its current range of $38,000 to $43,100.

| 👉Hot News: Multichain Hacking Continues, Losses Grow $3M! |

According to Rekt Capital, Bitcoin is “consolidating within the $38,000 to $43,100 range,” but it needs to hold this support level to avoid falling into a lower consolidation range.

Rekt Capital said, “Technically, it is the $38,000 support area that is preventing BTC from entering the $28,000-$38,000 consolidation range.

Managing Partner and Chief Investment Officer at ExoAlpha, who noted that "The huge head and shoulders pattern for BTC shoulders is now complete with a broken neckline with BTC at $38,300.

From a theoretical perspective, Lifchitz noted that this pattern represents a potential drawdown." of just $20,000.

But explained that the “overall decline was smaller” and suggested that the “$31,000 region could definitely be on the horizon.”

From a fundamental perspective, Lifchitz pointed to several factors creating headwinds for BTC, including Fed tightening, talks by EU regulators.

While trying to ban proof-of-work mining, G profit-taking from the end of 2021, and continued uncertainty about the economic future in relation to the Covid pandemic.

Lifchitz said, “So, bitcoin could definitely see a drop to $30,000 just before real buyers emerge.

Traders Looking to Take BTC to $30,000

A look at how traders have reacted to this drop compared to the June 2021 pullback was provided by analyst and Cointelegraph contributor Michaël van de Poppe.

Who published the chart below, which shows the key support zones for each period of weakness are highlighted.

Van de Poppe said: “In June → people expect the purchase of 23,000 to 25,000 dollars. Right Now → People are waiting for $30,000 to buy them.

The view was offered by the trader and pseudonymous Twitter user Fomocap, who posted the chart below, outlining how BTC could perform in the coming days.